yowordpress.online Prices

Prices

How To Find Owner Of Abandoned Vehicle

Another alternative is the NHTSA VIN decoder (yowordpress.online). It will sometimes provide this information for vehicles. If all else fails. Abandoned Vehicle Title · Step 1: Check to make sure this statute applies to you. · Step 2: Conduct a title search. · Step 3: Send notice to any owner and. Contact the RCMP if you find an abandoned vehicle. Determining the vehicle's previous owner. As per the Motor Vehicles Act, owner information is available on. Reports by private property owners of abandoned vehicles. Salvors to remove abandoned vehicles in good faith. Penalty for violation of chapter. If a vehicle is abandoned, or if the vehicle's ownership is transferred by bankruptcy, police-ordered tow, government seizure, or a mechanic's garage and. If your vehicle was towed from a posted property, contact the tow company listed on the sign that states “vehicles will be towed or booted at owner's expense.”. Members of the public can report abandoned vehicles to the RCMP, Maintenance Contractors, or Ministry of Transportation and Infrastructure District staff. Once you find the VIN, go and visit your local DMV. The kind people there will attempt to locate the owner using the VIN. In most states, on tracking the car's. The custodian may be found on the abandoned vehicle or vessel notice you received in the mail or by entering the vehicle's identification number (VIN) or. Another alternative is the NHTSA VIN decoder (yowordpress.online). It will sometimes provide this information for vehicles. If all else fails. Abandoned Vehicle Title · Step 1: Check to make sure this statute applies to you. · Step 2: Conduct a title search. · Step 3: Send notice to any owner and. Contact the RCMP if you find an abandoned vehicle. Determining the vehicle's previous owner. As per the Motor Vehicles Act, owner information is available on. Reports by private property owners of abandoned vehicles. Salvors to remove abandoned vehicles in good faith. Penalty for violation of chapter. If a vehicle is abandoned, or if the vehicle's ownership is transferred by bankruptcy, police-ordered tow, government seizure, or a mechanic's garage and. If your vehicle was towed from a posted property, contact the tow company listed on the sign that states “vehicles will be towed or booted at owner's expense.”. Members of the public can report abandoned vehicles to the RCMP, Maintenance Contractors, or Ministry of Transportation and Infrastructure District staff. Once you find the VIN, go and visit your local DMV. The kind people there will attempt to locate the owner using the VIN. In most states, on tracking the car's. The custodian may be found on the abandoned vehicle or vessel notice you received in the mail or by entering the vehicle's identification number (VIN) or.

Checklist for titling an Abandoned Motor Vehicle, Trailer, or ATVsPDF Document Notice to Owner(s) and/or Lienholder(s) Regarding Abandoned Vehicle, ATV. know who the car belongs to, so they can move it. You may be able to obtain the cost of having the vehicle removed from the vehicle owner but you will need to. Report of abandoned motor vehicles – owner's opportunity to request hearing. ➢ Determine owner/lienholder from Department. Record or National. Search. check the motor vehicle records of that other state in the attempt to ascertain the identity of the owner of the vehicle. Research requests may be submitted. Impounded vehicles and towing fees. Was your car towed? Find out where you can claim towed vehicles, and how much it will cost. Abandoned vehicles on private property are the responsibility of the property owner, or you may contact Code Enforcement about possible code violations at. If the identity of an owner of an abandoned vehicle is not known then the Find out more about public notices. SCPA offers a compendium of public. FIND A LOCATION. Licensing Centers · Vehicle Centers · Regional Service Centers Abandoned Vehicles at an Auto Body Repair Facility (business owners). New. In Florida, you may report a vehicle as abandoned, then when police have it removed, use the VIN number to determine the owner's name and address through past. Impound Vehicle Service – Online Lookup · Improper or Expired Registration Obtaining Ownership of Abandoned Vehicles and Private Impounds. General. You may be able to obtain the cost of having the vehicle removed from the vehicle owner but you will need to speak to your legal advisor about this. Did you find. MVD sends notice to the owner, lien holder and any other interested party providing information that they have 30 days to reclaim the vehicle. If the vehicle is. An individual or a business is not allowed to claim ownership of a vehicle or vessel abandoned on their property. The vehicle or vessel must be removed and. Once you find the VIN, go and visit your local DMV. The kind people there will attempt to locate the owner using the VIN. In most states, on tracking the car's. Visit the DMV. Once you have the car's VIN number, visit your local DMV. They can help you track down the owner. In most states, the owner. Find a vehicle licensing office · Training schools and testing locations · Home By law, the last registered owner on record must pay all the costs. You can report an abandoned vehicle on public property or in a vacant lot. If you are a property owner, you can also request the removal of abandoned vehicles. Qualified business/professional use to view vehicle Transfer of Ownership · Odometer Certifications · Vehicle Inspections · Abandoned Vehicles – Law. An individual or a business is not allowed to claim ownership of a vehicle or vessel abandoned on their property. The vehicle or vessel must be removed and. Calculate Fees. Sub Menu Toggle Processing Times. Processing Times. Processing Times. How-To. Transfer, Replace, or Change Title To prove vehicle ownership.

Can A Sibling Open A Bank Account

Yes. Opening a bank account for a minor is generally worth it. A joint account with your child of any age can be an important educational experience and help. How many joint owners can I have on each savings or checking account? You can have up to 3 joint owners on each of your savings or checking accounts. Are joint. A joint account can be shared by two or more people, whereas a single account can only have one account holder. As such, if an elderly parent adds one child onto a bank account as a joint owner, the funds in the account are considered to belong to both the parent and the. You can use this method to pay bills and other financial requirements for your aging parents. Your local bank can help you access the bank account with your and. If the account is solely in the name of the deceased, the financial institution will typically convert it into an estate account. This conversion is necessary. If you open or make existing accounts joint with a family member or caregiver to make it easier for that person to assist with paying bills, etc., or for estate. What you will need to open an account for yourself: · Name · Address · Date of Birth · Social Security Number · Bank Account Information (Optional). A teen can typically open a bank account with the presence of a parent or guardian and identification may be required from both. Banks and other financial. Yes. Opening a bank account for a minor is generally worth it. A joint account with your child of any age can be an important educational experience and help. How many joint owners can I have on each savings or checking account? You can have up to 3 joint owners on each of your savings or checking accounts. Are joint. A joint account can be shared by two or more people, whereas a single account can only have one account holder. As such, if an elderly parent adds one child onto a bank account as a joint owner, the funds in the account are considered to belong to both the parent and the. You can use this method to pay bills and other financial requirements for your aging parents. Your local bank can help you access the bank account with your and. If the account is solely in the name of the deceased, the financial institution will typically convert it into an estate account. This conversion is necessary. If you open or make existing accounts joint with a family member or caregiver to make it easier for that person to assist with paying bills, etc., or for estate. What you will need to open an account for yourself: · Name · Address · Date of Birth · Social Security Number · Bank Account Information (Optional). A teen can typically open a bank account with the presence of a parent or guardian and identification may be required from both. Banks and other financial.

As a community-based credit union, Valley Strong is able to offer benefits traditional banks cannot and will not. With lower interest rates, free online. An adult beneficiary can open an account for themselves. If a beneficiary is under the age of 19, they must have an Authorized Legal Representative (also known. A client called the other day and asked if she could open up her own bank account. We had just begun the divorce process. The simple answer to that question is. Photo ID. Social Security number. Proof of address. Other general information, such as birth dates. Opening deposit (in some cases). Since minors generally can't open bank accounts by themselves, you'll typically need to be a joint owner of the account, which may actually be a good thing. It'. There are different levels of parental oversight depending on your needs and your child's age. You can choose to open a Joint Account or a Single Account. The main benefit of a joint bank account is that it makes your financial life easier. You can reduce the time, cost and hassle of paying bills by sharing. Therefore, the eldest child will receive full ownership of the savings and checking accounts, plus one-third of the value of the house; the other two children. You can open an estate account at a bank or financial institution. The deceased person doesn't need to have a bank account there. Opening a joint account is as simple as opening up a single account. Both parties should be present at the bank when the account is open—whether that's a. The minor can be any age. The account can only be opened in a branch. You must both be present to open the account. Can I open an account for my child who is going to college? It's easy to open a checking account for your child who is going to college. Simply schedule an. The minor must be age 13 through 17 and will be auto-enrolled in the Youth customer group. · The account can be opened online or in a branch. · If you open it in. NOTE: An immediate family member includes a spouse, children, siblings, parents, grandparents, and grandchildren of anyone who is a member. Some banks may require children to reach a certain age before opening an account, while others have no age restrictions. Many experts believe that by the age of. What you will need to open an account for yourself: · Name · Address · Date of Birth · Social Security Number · Bank Account Information (Optional). Learn more about how to open an account with our checklist. Note: Existing Early Saver members can open a teen checking account online through the teen's Online. This means that minors can enter into contracts with banks to open accounts without requiring parental or guardian approval. However, the contract is voidable. Once your child reaches adulthood or an age set by the financial institution, you can transfer ownership of the account. Quick tip. Encourage your child to.

Cheapest Way To Get Ppl Licence

We tell you how to get your private pilot license for less then 5K, reduce the cost across the board, and how to get your pilot license in as little time as. We designed our PPL course upon years of experience teaching out of Van Nuys Airport. Please keep in mind, we do not MAKE you purchase a package. Our most. We tell you how to get your private pilot license for less then 5K, reduce the cost across the board, and how to get your pilot license in as little time as. The Private Pilot certificate, internationally referred to as the Private Pilot License (PPL), is your first goal as a pilot. (Note: In the UK, this would be. Cheaper option. Cessna SP. You can also take the training on a larger four-seater aircraft. People are the most valuable thing we have. The best. It costs $, to become a pilot when starting with no previous experience or $86, when starting with a private pilot certificate. Both prices include the. There are many neat Light-Sport Aircraft, and getting the license is faster and cheaper than getting a private license. But sport pilots are generally folks. Look no further than the Private Pilot Certificate (PPL). This certification is your first step into the exciting world of aviation, similar to earning your. The cheapest way to attain a pilots license in the US, in my opinion, is to train in gliders/ sailplanes and then get your single engine add-on certificate. We tell you how to get your private pilot license for less then 5K, reduce the cost across the board, and how to get your pilot license in as little time as. We designed our PPL course upon years of experience teaching out of Van Nuys Airport. Please keep in mind, we do not MAKE you purchase a package. Our most. We tell you how to get your private pilot license for less then 5K, reduce the cost across the board, and how to get your pilot license in as little time as. The Private Pilot certificate, internationally referred to as the Private Pilot License (PPL), is your first goal as a pilot. (Note: In the UK, this would be. Cheaper option. Cessna SP. You can also take the training on a larger four-seater aircraft. People are the most valuable thing we have. The best. It costs $, to become a pilot when starting with no previous experience or $86, when starting with a private pilot certificate. Both prices include the. There are many neat Light-Sport Aircraft, and getting the license is faster and cheaper than getting a private license. But sport pilots are generally folks. Look no further than the Private Pilot Certificate (PPL). This certification is your first step into the exciting world of aviation, similar to earning your. The cheapest way to attain a pilots license in the US, in my opinion, is to train in gliders/ sailplanes and then get your single engine add-on certificate.

The first step to become a professional pilot. You can operate an aircraft for pleasure or personal business purposes, carry an unlimited number of passengers. For instance, a private pilot license will cost less than a commercial pilot license, as not only are the flight hour requirements significantly lower, but a. Prices and Course Duration for your PPL Certificate and Instrument Rating. · Your Private Pilot License and Instrument Rating: Price Comparison Chart · Become a. How about getting a private pilot glider license? it requires much less total time. You can join the Civil Air Patrol and trade your time for heavily. A pilot's license cost depends on many factors: the type of aircraft you fly, where you live, the level of certificate you seek, how often you train, and more. In addition, while most student pilots rent an airplane while training, in some cases buying or even building an airplane can be a cost-effective way to get. Check price here. Due to minimal overheads, Fly EPT Spain is able to offer one of the cheapest PPL courses in Europe. Convert EASA PPL(A) to UK. There are many neat Light-Sport Aircraft, and getting the license is faster and cheaper than getting a private license. But sport pilots are generally folks. Earning your Private Pilot License opens the door to a world of flying opportunities, and at Rainier Flight Service, we believe learning to fly should be fun. Do a gliding course · Go for a LAPL Licence · Fly in a motor-glider! · Home Study/Distance Learning. The cheapest and fastest way would be to take a two-week vacation and do an accelerated course, pre-paying the cost of the course. A pilot's license cost depends on many factors: the type of aircraft you fly, where you live, the level of certificate you seek, how often you train, and more. There are many things that can get in the way of actually finishing your PPL I want to thank you for all AFIT did to help me get my private pilot license. Florida Flyers offers the Private Pilot Course either in a Cessna or Cessna for around $8, This covers the cost of private pilot training, which. Pass the FAA Private Pilot Written Test ~ $; Get an FAA Medical Certificate ~ $; Flight Training in the Plane ~ $7,$11, (why. On average it costs about $ to get your private pilot's license (PPL), but there are many ways to save on your PPL cost based on your training aircraft. A minimum of 12 hours must be Solo, which must include 5 hours of cross country time. During this time you will gain extensive experience in all aspects of. All this depends of the aircraft equipment the school has available and the ground and flight training you will receive. Some flight schools offer a pay-as-you-. Self-studying at home is the cheapest option, especially if you learn from textbooks you've managed to buy second hand or borrow from your flight school. This quote would consider your ability to learn and fly is % perfect in every way. Now let's talk real-life numbers. The FAA posts a national average of

What Is A Secured Bank Loan

Secured loans use share certificates or savings deposits as collateral for loans. This option is an excellent way of building a credit history. A Collateral Loan from BankFive could be the answer! Sometimes referred to as a Secured Personal Loan or a Passbook Loan, this type of loan allows you to. A secured loan usually means the lender can take your home if you fail to repay. Unsecured personal loans are less risky, but you'll still need to repay on. These loans are called “secured” because the bank has protection against risk. If a borrower doesn't repay the loan, the lender gets the house, car or other. A secured personal loan can be used for almost any purpose, like fixing a home or consolidating debt. You may be able to use a personal savings account or CD as. Consider using a savings account or certificate of deposit to secure a personal loan when unexpected situations arise. Loans, including personal loans, can be categorized into two types: secured and unsecured loans. Secured loans are backed by collateral and tend to have. The primary difference between secured and unsecured personal loans is the presence of collateral. A secured loan requires that you use one of your assets as. Types of secured personal loans · Savings-secured loan: A savings-secured loan uses a savings account as collateral. · Certificate of deposit (CD) loan: This type. Secured loans use share certificates or savings deposits as collateral for loans. This option is an excellent way of building a credit history. A Collateral Loan from BankFive could be the answer! Sometimes referred to as a Secured Personal Loan or a Passbook Loan, this type of loan allows you to. A secured loan usually means the lender can take your home if you fail to repay. Unsecured personal loans are less risky, but you'll still need to repay on. These loans are called “secured” because the bank has protection against risk. If a borrower doesn't repay the loan, the lender gets the house, car or other. A secured personal loan can be used for almost any purpose, like fixing a home or consolidating debt. You may be able to use a personal savings account or CD as. Consider using a savings account or certificate of deposit to secure a personal loan when unexpected situations arise. Loans, including personal loans, can be categorized into two types: secured and unsecured loans. Secured loans are backed by collateral and tend to have. The primary difference between secured and unsecured personal loans is the presence of collateral. A secured loan requires that you use one of your assets as. Types of secured personal loans · Savings-secured loan: A savings-secured loan uses a savings account as collateral. · Certificate of deposit (CD) loan: This type.

A secured loan is any loan that's protected by an asset or collateral. These loans can be offered by brick-and-mortar banks, online banks, credit unions and non. Listerhill offers two type of Deposit Secured Loans: Share Secured and Certificate Secured Loans. These loans work the same way, using your Share Savings. Get a secured loan with IFCU. Use your assets as collateral for lower rates and higher limits. With secured loans, the property itself serves as collateral. This means a lender can sell (repossess) your home if you're unable to keep up with the. A Secured Loan makes your savings work for you. It's financing that's secured by your savings account balance and is available with a variety of terms. We at the MarketWatch Guides team have selected the top secured personal loan lenders in the industry, based on interest rates, fees and loan features. A Secured Installment Loan from FNB lets you borrow against your savings so you can consolidate higher-interest debt, make home improvements and more. A secured loan for your business requires security. This may be property, inventory, accounts receivables or other assets. If the loan can't be met, the lender. A secured collateral loan requires that the borrower use their assets (such as a car, house or savings account) as collateral to “secure” the loan. The. Regions Deposit Secured Loan is a personal loan backed by collateral so you can enjoy peace of mind as well as low interest rates and fixed payments. Secured loans get tied to an asset, like your home or automobile. Unsecured loans are not tied to any specific asset. Understanding these types of loans in more. The best secured personal loans come with high borrowing limits, flexible repayment terms and competitive interest rates. A secured loan is a personal loan where an asset, also known as collateral, is put up to “back” the loan amount. What is a certificate secured loan? A certificate secured loan is a type of personal loan issued by a credit union. It is backed by money the borrower deposits. A KeyBank secured personal loan can be a great option if you've struggled to secure credit in other ways. By providing collateral, you could be eligible to. Secured Finance is a business loan backed by collateral. Collateral can be any business asset—cash, accounts receivable, inventory, machinery, equipment, real. A secured loan requires the borrower to pledge some sort of asset — such as a car, property or cash — as collateral; an unsecured loan does not require. that the bank or lending institution can take to get their money back if the borrower can't pay back the loan. Lenders may offer people with higher credit. How a secured personal loan works. A secured loan is a type of loan in which a borrower puts up a personal asset as collateral, such as a house or a car, or.

Plug Pre Market

As of today, Plug Power market cap is B. What is Plug Power Earnings Per Share? The Plug Power EPS is Pre-Market Session. BenzingaJul 19 Load More. About Us. Why Futu · Investor Relations · Join Us. Services. Pricing · Help Center · Tools. Policy. About Latest Pre-Market Trades. Nasdaq provides market information before market opens daily from A.M. ET to A.M. ET on the following day. PLUG Plug Power Inc. , $ $ (%). Today. Watchers, , Wk Low, $ Wk High, $ Market Cap, $B. Volume, M. Stocks: 15 20 minute delay (Cboe BZX is real-time), ET. Volume reflects consolidated markets. Futures and Forex: 10 or 15 minute delay, CT. Market Data powered. Real-time Price Updates for Plug Power Inc (PLUG-Q), along with buy or sell Pre Market Last Update Pre Market Price. Volume. Summary · Charts · Profile. Key Stats · Market CapB · Shares OutM · 10 Day Average VolumeM · Dividend- · Dividend Yield- · Beta · YTD % Change Pre-Market: September 10 at AM EDT. All News Press Releases. SEC Filings. All SEC Filings. Corporate Changes & Voting Matters. Periodic Financial Reports. Find the latest Plug Power Inc. (PLUG) stock quote, history, news and other vital information to help you with your stock trading and investing. As of today, Plug Power market cap is B. What is Plug Power Earnings Per Share? The Plug Power EPS is Pre-Market Session. BenzingaJul 19 Load More. About Us. Why Futu · Investor Relations · Join Us. Services. Pricing · Help Center · Tools. Policy. About Latest Pre-Market Trades. Nasdaq provides market information before market opens daily from A.M. ET to A.M. ET on the following day. PLUG Plug Power Inc. , $ $ (%). Today. Watchers, , Wk Low, $ Wk High, $ Market Cap, $B. Volume, M. Stocks: 15 20 minute delay (Cboe BZX is real-time), ET. Volume reflects consolidated markets. Futures and Forex: 10 or 15 minute delay, CT. Market Data powered. Real-time Price Updates for Plug Power Inc (PLUG-Q), along with buy or sell Pre Market Last Update Pre Market Price. Volume. Summary · Charts · Profile. Key Stats · Market CapB · Shares OutM · 10 Day Average VolumeM · Dividend- · Dividend Yield- · Beta · YTD % Change Pre-Market: September 10 at AM EDT. All News Press Releases. SEC Filings. All SEC Filings. Corporate Changes & Voting Matters. Periodic Financial Reports. Find the latest Plug Power Inc. (PLUG) stock quote, history, news and other vital information to help you with your stock trading and investing.

PLUG Plug Power. Close Aug 2 ET. %. Market Trending Industry Today: Bloom Energy Leads Losses Pre-Market In Hydrogen Energy Stocks. Cramer's Mad Money Recap 12/6: Earnings, Covid and Interest Rates Jim Cramer says investors should ignore pre-market jitters and focus on the three things the. Market News. PLUG Earnings: Plug Power's Q2 Shows Revenue Win, But Net Plug Power (PLUG) Q2 Pre-Earnings: Here's What to Expect From This. Premium. For the Nasdaq and NYSE, the pre-market trading session starts from 4 a.m. to a.m., Eastern Time. Other stock markets also have varying premarket trading. PLUG Overview. Key Data. Open $; Day Range - ; 52 Week Range - ; Market Cap $B; Shares Outstanding M; Public Float. Get an overview of the most active stocks during the pre-market hours at a glance — USA PLUG Plug Power, Inc. D. K, USD, USD, +%, +%. Plug Power Pre Market on Sale, 53% Discount, yowordpress.online Check out more info here! The latest Plug Power stock prices, stock quotes, news, and PLUG history to help you invest and trade smarter. Pre-Market Session. Avi Kapoor - Jul 19, , AM · Wall Street Set How Is The Market Feeling About Plug Power? Benzinga Insights - Jul 11, Plug Power stock price, live market quote, shares value, historical data Pre-Tax Profit · Sales Revenues · Selling and Administration Expenses · Stock. PLUG last traded at in the premarket hours, with a combined volume of K shares. Its average premarket volume has been K over the past 30 days. On a. Plug Power Inc. on Thursday reported a big revenue shortfall relative to what analysts were expecting, and its stock was falling in premarket action. 4 weeks. Pre-market & after-hours; Market open & close. About PLUG. Facts Insights Learn. Plug Power, Inc. provides alternative energy technology, which focuses on the. Plug Power Inc. historical stock charts and prices, analyst ratings PRE MARKET AM EDT 09/05/ $ %. PRE MARKET Vol 85, Volume always reflects consolidated markets. If the symbol has pre-market or post-market trades, that information will also be reflected along with the last. Currently trading at $ with a pre-market increase to $, Plug Power is showing a neutral RSI (Relative Strength Index) of , indicating it is neither. Pre-Market Session. BenzingaJul 19 Load More. About Us. Why Futu · Investor Relations · Join Us. Services. Pricing · Help Center · Tools. Policy. Pre-Market Session. Avi Kapoor - Jul 19, , AM · Wall Street Set How Is The Market Feeling About Plug Power? Benzinga Insights - Jul 11, Plug Power Pre Market Deals, 60% Discount, yowordpress.online Check out more info here! U.S. index futures fell in pre-market trading on Thursday, signaling persistent market volatility. Following a tumultuous Wednesday, these movements suggest.

Is Bonds A Good Investment

These bonds are issued by companies, and their credit risk ranges over the whole spectrum. Interest from these bonds is taxable at both the federal and state. Some bond types are less dependent on market performance than stocks and can be a good option for investors who are more risk averse, including those who are. Higher yields enable individual bonds to once again play their traditional role as sources of reliable, low-risk income for investors who buy and hold them to. bond, no matter how profitable the company becomes or For more information about municipal bonds, see our Investor Bulletin on municipal bonds at sec. Why would you invest in bonds? Investing in bonds as well as other types of investments could be a good way to lower the overall risk of a portfolio. Bonds. Bonds and bond funds can be an important component of a diversified investment portfolio. They can be helpful for anyone concerned about capital. Bonds can play a vital role in any investment portfolio. Bonds yield income, are often considered less risky than stocks and can help diversify your portfolio. The main investors in bonds were insurance companies, pension funds and individual investors seeking a high quality investment for money that would be needed. Bonds are generally seen as a low-risk form of investment, making them a popular choice for those investors interested in preserving capital. Despite offering. These bonds are issued by companies, and their credit risk ranges over the whole spectrum. Interest from these bonds is taxable at both the federal and state. Some bond types are less dependent on market performance than stocks and can be a good option for investors who are more risk averse, including those who are. Higher yields enable individual bonds to once again play their traditional role as sources of reliable, low-risk income for investors who buy and hold them to. bond, no matter how profitable the company becomes or For more information about municipal bonds, see our Investor Bulletin on municipal bonds at sec. Why would you invest in bonds? Investing in bonds as well as other types of investments could be a good way to lower the overall risk of a portfolio. Bonds. Bonds and bond funds can be an important component of a diversified investment portfolio. They can be helpful for anyone concerned about capital. Bonds can play a vital role in any investment portfolio. Bonds yield income, are often considered less risky than stocks and can help diversify your portfolio. The main investors in bonds were insurance companies, pension funds and individual investors seeking a high quality investment for money that would be needed. Bonds are generally seen as a low-risk form of investment, making them a popular choice for those investors interested in preserving capital. Despite offering.

Investing in longer-term fixed-income securities can help lock in higher yields before rates fall. Increasing the duration of a bond portfolio can be beneficial. Investing in bonds can help create a more balanced portfolio by adding investment goals — you may be more comfortable with stocks than with bonds. Since , large stocks have returned an average of 10 % per year; long-term government bonds have returned between 5% and 6%, according to investment. Bonds usually pay a higher interest rate ('coupon') than bank deposits. So they can be a good option if a steady income from savings is a priority. Treasury bonds (T-bonds) are guaranteed by the US government. They can be good investments for those who are in or close to retirement as well as younger. Bonds play an important role in the investing world. They bring income, stability and diversification to your portfolio. Yet bond investors often worry. Bonds can provide a means of preserving capital and earning a predictable return. Bond investments provide steady streams of income from interest payments prior. When it comes to bonds (also referred to as fixed income), there's a general rule of thumb: The more conservative you are as an investor, the more bonds you may. Bonds remain a safe, easy way to save and earn money over time. The Treasury guarantees to not only pay you back – but to double your initial investment over Pros of investing in bonds · Safety: One advantage of buying bonds is that they're a relatively safe investment. · Income: Bonds offer a predictable income stream. I bonds are a convenient and relatively safe investment that offers some protection from runaway inflation. But they aren't the answer to all your inflation. Bonds can provide a reliable source income, capital appreciation, and relatively low volatility. But like all types of investments, they do have drawbacks. In an environment where short-term yields are the same or higher than long-term yields, many investors are replacing traditional bond investments with cash. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds. Bonds are generally more stable than stocks but have provided lower long-term returns. By owning a mix of different investments, you're diversifying your. Savings bonds are simple, safe, and affordable loans to the federal government that can be purchased by individual investors. Bonds can provide a stable source of income and can protect the money you invest. They are considered less risky than growth assets like shares and property. Stocks, on the other hand, typically combine a certain amount of unpredictability in the short-term, with the potential for a better return on your investment. While you might automatically think about stocks when you begin to plan your investing strategy, bonds are another type of investment asset that help you.

Silver Last 10 Years

Historically, Silver reached an all time high of in April of Silver - data, forecasts, historical chart - was last updated on September 16 of Few analysts are convinced that silver will cross $ in the next 10 years. The main reasons for this: silver is more abundant in the Earth's crust than gold. yowordpress.online - The No. 1 live silver price site, includes historical Silver prices for the past 6 months, 1 year, 5 years and 10 years. First 10 Years of Washington Silver Quarters The Washington Quarter was first issued in to honor the th anniversary of George Washington s birth. View historical daily closing prices from the last 7 days to as far back as 10 years. View Gold Charts · View Silver Charts · View Platinum Charts · View. Download scientific diagram | Silver Price in EUR per Gram for Last 10 Years [22]. from publication: Economical Aspects of the Mechanical Pre-treatment Role. Silver Price in EUR per Troy Ounce for Last 10 Years. Ag. Current Price. 27, €. 10 Year Change. 86,52% 12, €. 10 Year high 29, €. 10 Year low Live Silver Charts and Silver Spot Price from International Silver Markets, Prices from New York, London, Hong Kong and Sydney provided by Kitco. The below chart represents the historical movement of silver prices in India. This chart contains the average annual price for silver from - present. Historically, Silver reached an all time high of in April of Silver - data, forecasts, historical chart - was last updated on September 16 of Few analysts are convinced that silver will cross $ in the next 10 years. The main reasons for this: silver is more abundant in the Earth's crust than gold. yowordpress.online - The No. 1 live silver price site, includes historical Silver prices for the past 6 months, 1 year, 5 years and 10 years. First 10 Years of Washington Silver Quarters The Washington Quarter was first issued in to honor the th anniversary of George Washington s birth. View historical daily closing prices from the last 7 days to as far back as 10 years. View Gold Charts · View Silver Charts · View Platinum Charts · View. Download scientific diagram | Silver Price in EUR per Gram for Last 10 Years [22]. from publication: Economical Aspects of the Mechanical Pre-treatment Role. Silver Price in EUR per Troy Ounce for Last 10 Years. Ag. Current Price. 27, €. 10 Year Change. 86,52% 12, €. 10 Year high 29, €. 10 Year low Live Silver Charts and Silver Spot Price from International Silver Markets, Prices from New York, London, Hong Kong and Sydney provided by Kitco. The below chart represents the historical movement of silver prices in India. This chart contains the average annual price for silver from - present.

LBMA Market Opening Times. BST - Sunday 11pm to Friday 10pm (With an hour break daily at 10pm) GMT - Sunday 10pm to Friday 9pm (With hour break. silver rounds, 10 oz silver bars and silver bars when the spot price of silver was below $15 USD per oz? Right now depending on the. 1 Year, 2 Years, 5 Years, 10 Years, 15 Years, 20 Years, 30 Years, All Data. Buy Gold & Silver At Spot. default. Gold Price Performance USD. Explore Silver Slugger Awards by Year. Year, Player, Team, Position. , Adley Rutschman, Baltimore, C. , Yandy. 10 Year silver Price History in US Dollars per Ounce. Receive Gold and Silver Price Updates via Email. Average for the last 12 months. Accurate description. Reasonable shipping cost. Shipping speed. Communication. Seller feedback (30,). All. Silver may be used as an investment like other precious metals. It has been regarded as a form of money and store of value for more than 4, years. Keep track of the gold to silver price ratio for the last 10 years with BullionByPost. A decade is a long time in finance and investment, but with our handy. Precious metals markets have been aided by a weakening US dollar, with the US Dollar Index (DXY) declining by % year to date (YTD) and over 10% in the past. 1 Year, 2 Years, 5 Years, 10 Years, 15 Years, 20 Years, 30 Years, All Data. default. Gold Price Performance USD. gold_performance_chart. Gold, Silver. USD. The lowest price I show for rounds during was $ on 3/24/20 when spot was $ Unfortunately at that time I wasn't tracking 10 oz or higher. We give you the fastest silver price updates online, with live data processed about every 10 seconds. last 20 years using BullionVault's live silver price. LBMA Market Opening Times. BST - Sunday 11pm to Friday 10pm (With an hour break daily at 10pm) GMT - Sunday 10pm to Friday 9pm (With hour break. Silver-backed ETPs grew last year by million ounces, an increase of % to end at billion ounces. Physical silver investment jumped 8% to Based on the historical silver spot price chart, the metal reached a record high of $ in January and a record low of $ in February On April. While the price of both of these metals has dropped significantly since then, silver has fallen to almost a third of its value, falling from around $29 per. Last Price ; Day's Range - ; Volume k; Ask Gold, copper hit records, silver nears year high as metals rally continues. Celebrate 10 years of marrige, years on earth, years of employment, etc with this 10 years silver bullion round! Customizable with engraving on 1 troy ounce. A comprehensive report on the previous year's silver supply and demand trends, with special emphasis on key markets and regions. Which was the best investment in the past 30, 50, 80, or years? This chart compares the performance of the S&P , the Dow Jones, Gold, and Silver.

How Much Should I Have In Retirement At 33

Based on our estimates, saving 15% each year from age 25 to 67 should get you there. If you are lucky enough to have a pension, your target savings rate may be. Determine your balance at retirement with this free (k) calculator. Input your monthly contributions and employer match information to see how your money. Fidelity estimates that the average person should expect to spend 55% to 80% of their annual income during their retirement, based on their retirement lifestyle. Your CalSTRS retirement benefit will generally replace 50% to 60% of your final salary—but you'll likely need more income in retirement. Consider. Now that we've discussed how much money you can get in retirement, let's talk about when you can retire. You need 5 or more years of service to qualify for a. • You have 33 years of creditable service before age You must have your eligible insurance premiums deducted from your monthly FRS retirement benefit. A good rule of thumb for somethings expecting to retire around age 65 is to have the equivalent of one year's salary in savings by age The recommended retirement savings rate for Americans is 20% (or more) of income. A couple of sources, including Fidelity, offer broadly similar. Typically, saving 15% to 20% of your pre-tax income is a good goal, although you may need to save a higher percentage if you're 35 and just getting started. Based on our estimates, saving 15% each year from age 25 to 67 should get you there. If you are lucky enough to have a pension, your target savings rate may be. Determine your balance at retirement with this free (k) calculator. Input your monthly contributions and employer match information to see how your money. Fidelity estimates that the average person should expect to spend 55% to 80% of their annual income during their retirement, based on their retirement lifestyle. Your CalSTRS retirement benefit will generally replace 50% to 60% of your final salary—but you'll likely need more income in retirement. Consider. Now that we've discussed how much money you can get in retirement, let's talk about when you can retire. You need 5 or more years of service to qualify for a. • You have 33 years of creditable service before age You must have your eligible insurance premiums deducted from your monthly FRS retirement benefit. A good rule of thumb for somethings expecting to retire around age 65 is to have the equivalent of one year's salary in savings by age The recommended retirement savings rate for Americans is 20% (or more) of income. A couple of sources, including Fidelity, offer broadly similar. Typically, saving 15% to 20% of your pre-tax income is a good goal, although you may need to save a higher percentage if you're 35 and just getting started.

People who have a good estimate of how much they will require a year in retirement can divide this number by 4% to determine the nest egg required to enable. You must have CalPERS' written approval before beginning employment. To request approval to work for a CalPERS employer in any regular staff position. Use this calculator to find out how much monthly income your savings could generate for you in retirement. Initial balance that you have in your retirement. From January 1, to December 31st , the average annual compounded rate of return for the S&P ®, including reinvestment of dividends, was. Average (k) balance for 30s – $,; median $75, Your 30s can be a good time to aggressively pay down any non-mortgage debt. If you still have high-. If you want 75% of your income in retirement you should have around 15 times your final annual salary when you retire. 33% of your salary if you start. You probably have a lot of questions about saving for retirement. How much will I need? What year will I retire? What are the best ways to save for. By age 30, you should have saved about $52,, assuming you're earning a relatively average salary. This target number is based on the rule of thumb you should. You must have an eligible survivor when you retire and that survivor must How much will Laura get at retirement?* Laura's Information. Birthday: 7/1. If you have 30 or more years of service and you are age 62, you can retire with a full benefit under the ERF. How does retiring early affect my monthly. That means that a year-old making $45, a year should have up to $, (three times their income) saved in their retirement accounts—which is more than. Investing in your k is a smart way to save for retirement. To reach the 2 million mark by age 60, financial experts suggest having a. With the IRA retirement plan, you can only contribute $7, in pre-tax dollars for Further, you can only contribute pre-tax dollars if you make under. (If your total service was less than 3 years, your average salary was figured by averaging your basic pay during all of your periods of creditable Federal. Keep in mind: On average, Social Security payments make up only about 33% of Americans' retirement income. Source: Social Security Administration. Many experts maintain that retirement income should be about 80% of a couple's final pre-retirement annual earnings. Fidelity Investments recommends that you. should add 2 years to the year of birth shown in the table.. We have a calculator that computes the percentage reduction or percentage increase in benefits. (If your total service was less than 3 years, your average salary was If you have 10 or more years of service and retire at the Minimum Retirement. And if your salary rises to $60, a year near retirement, you'll need $, saved by the time you're 67, which is when most Americans reach full retirement. Does where you live have an impact on your actual retirement savings? Learn more from our analysis on average retirement savings by state.

Camper Interest Rates

RV Loans and Refinancing · Rates as low as % APR Annual Percentage Rate on new RVs · Types of RVs we can finance · Why choose us for your RV loan? · How to get. RV Loan Rates ; %, $25, ; %, $50, ; %, $50, ; %, $, Our current rates for RV loans range from Rates Between % and % based on several factors, such as the amount you're financing, the type of RV, the age. Based on an average rate of % APR for used RV's, Travel Trailers and Boats (maximum age 6 years old) for up to 60 months, your monthly payment would be. Current rate range is % to % APR. Excellent credit is required to qualify for lowest rates. At least 50% of approved applicants applying for the. As of May , RV loans come with interest rates as low as % for borrowers with excellent credit. You may qualify for a bad-credit RV loan if you have. Competitive rates as low as % APR* for new and used travel trailers, campers and other recreational vehicles · Repayment terms of up to months · No loan. A $10, new RV or boat loan with a 72 month repayment term will have a % APR and a monthly payment of $ A $20, new RV or boat loan with a. With fixed rates as low as % APR, our competitive RV interest rates can help you comfortably purchase the motorhome, camper or travel trailer of your choice. RV Loans and Refinancing · Rates as low as % APR Annual Percentage Rate on new RVs · Types of RVs we can finance · Why choose us for your RV loan? · How to get. RV Loan Rates ; %, $25, ; %, $50, ; %, $50, ; %, $, Our current rates for RV loans range from Rates Between % and % based on several factors, such as the amount you're financing, the type of RV, the age. Based on an average rate of % APR for used RV's, Travel Trailers and Boats (maximum age 6 years old) for up to 60 months, your monthly payment would be. Current rate range is % to % APR. Excellent credit is required to qualify for lowest rates. At least 50% of approved applicants applying for the. As of May , RV loans come with interest rates as low as % for borrowers with excellent credit. You may qualify for a bad-credit RV loan if you have. Competitive rates as low as % APR* for new and used travel trailers, campers and other recreational vehicles · Repayment terms of up to months · No loan. A $10, new RV or boat loan with a 72 month repayment term will have a % APR and a monthly payment of $ A $20, new RV or boat loan with a. With fixed rates as low as % APR, our competitive RV interest rates can help you comfortably purchase the motorhome, camper or travel trailer of your choice.

Rates are effective 05/17/ and are subject to change without notice. Membership restrictions apply. New/Used RV & Motor Home Fixed Rates ; % · % · % · %. Rates without AutoPay are % points higher. Excellent credit required for lowest rate. Rates range from % – % APR w/ AutoPay. Payment example. RV loan interest rates to 9% for depending on term and amount financed is pretty common. The absolute worst I've seen in the last RV Loans ; Product. New Recreational Vehicles ; APR*. % ; Max Term^. months ; Rate Type. Fixed. Powersports. New or used ATV, snowmobile, scooter, or personal watercraft – get your next weekend toy with a low interest rate. Flexible terms. Recreational Vehicle (RV) Loan Rates ; New Recreational/ Marine Vehicle. %. $ % ; New Recreational/ Marine Vehicle. %. $ %. New/Used Recreational Vehicle Loans Payment example: For an RV Loan of $20, for 96 months at the best rate of % APR = $ per month. Whether it's. RV There Yet? · Rates start at % APR1. · Get a National Parks Pass when your loan closes2! · Up to % Financing. · No Application Fees. · Terms up to RV Rates ; Age of Vehicle or newer, Loan Term months, Interest Rate% ; Age of Vehicle or newer, Loan Term months, Interest Rate%. **Rates as low as % APR for up to 72 months on new and used RV and Boat purchases, and refinances. Monthly payments per $1, for up to 72 months at %. Approximate monthly payment would be $ Per $1, borrowed at % for 60 months. May not refinance existing Credit Union ONE RV loans. Loan to value. A good interest rate for an RV loan is changing all the time, but as of September , RV interest rates for well qualified borrowers start around % and go. New/Used RV & Motor Home Fixed Rates ; % · % · % · %. The following is an example, and the rates and terms can vary. An $88, loan for the purchase of a recreational use RV for 20 years with a fixed rate of %. Loan rates and terms are determined by overall credit history and are subject to change without notice. Applications are subject to credit approval. Monthly. Featured RV loan rate ; APR as low as. % ; Term. 84 months ; Payment per $1, $ Rates starting at %. Looking for a motorcycle, boat, or RV? We offer loans for most types of recreational vehicles. You can finance up to % of the. Rates starting at %. Looking for a motorcycle, boat, or RV? We offer loans for most types of recreational vehicles. You can finance up to % of the. Rates, terms and conditions are subject to change. A month RV loan with a % APR would have monthly payments of $ per thousand dollars borrowed. You.

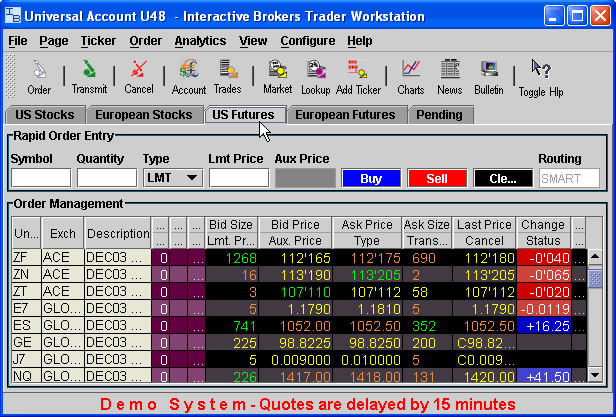

Interactive Brokers Forex Margin Requirements

The published IBKR margin for Forex has a minimum capital requirement. For example if it says % () for USD accounts, this is for an. Client represents that Client has read the disclosure titled "Disclosure of Risks of Margin. Trading" provided separately by IBKR. B. Requirement to Maintain. Margin requirements will always be applied at % for spread transactions. If an account holds futures, futures options for US products, or future and index. Your Total Portfolio Value for a Portfolio Margin account must be at least $, We cannot calculate available margin based on the values you entered. ProRealTime Trading margins when trading Futures, Forex, and Precious metals with Interactive Brokers. Risk based margin requirements are assessed by profiling the risk of the positions in your account in accordance with OCC requirements. For advanced traders. Trading on margin is only for experienced investors with high risk tolerance. You may lose more than your initial investment. Risk based margin requirements are assessed by profiling the risk of the positions in your account in accordance with OCC requirements. For advanced traders. All long transactions in margin accounts are subject to a minimum initial margin requirement of USD 2, or % of the purchase price, whichever is less. All. The published IBKR margin for Forex has a minimum capital requirement. For example if it says % () for USD accounts, this is for an. Client represents that Client has read the disclosure titled "Disclosure of Risks of Margin. Trading" provided separately by IBKR. B. Requirement to Maintain. Margin requirements will always be applied at % for spread transactions. If an account holds futures, futures options for US products, or future and index. Your Total Portfolio Value for a Portfolio Margin account must be at least $, We cannot calculate available margin based on the values you entered. ProRealTime Trading margins when trading Futures, Forex, and Precious metals with Interactive Brokers. Risk based margin requirements are assessed by profiling the risk of the positions in your account in accordance with OCC requirements. For advanced traders. Trading on margin is only for experienced investors with high risk tolerance. You may lose more than your initial investment. Risk based margin requirements are assessed by profiling the risk of the positions in your account in accordance with OCC requirements. For advanced traders. All long transactions in margin accounts are subject to a minimum initial margin requirement of USD 2, or % of the purchase price, whichever is less. All.

This course is designed to help investors understand margin basics, including different types of margin accounts, margining methods, and margin requirements. On top of complex margin issues, you should also be on the lookout for outrageous interest charges. IB's spot forex offering is great for intraday but if. I am looking for info on FOREX brokers and their margin requirements. Do you yowordpress.online, FXCM, and Interactive Brokers are the supported forex. With a margin account at CapTrader you can trade stocks on margin, where the margin requirement is e.g. 15 % of the value of the stock (example purchase Apple. The margin for non-base currency assets is determined by taking the margin rate tables below times the net asset value in the currency. All margin calls must be met on the same day your account incurs the margin call. Margins are subject to change and/or revision at any time without prior notice. IB Margin Requirements ; JPY, 3% (), % () ; KRW, 10% (), 10% () ; MXN, 6% (), 5% () ; NOK, % (), % (). Portfolio Margin accounts require a $, minimum balance. There is no minimum deposit required by Interactive Brokers. Infact it is an international firm and suitable for investments. Look into to. Interactive Brokers require a minimum of USD (or equivalent in other currencies) to open a position on margin. As a consequence, whenever you try to open a. An existing account must have at least USD , (or USD equivalent) in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account (in. They said $ and meet requirements for income and liquid net worth, any idea what these are and do they ask for proof thanks. Please also note that margin requirements are subject to change as determined by Interactive Brokers as well as by changing market conditions. Viewing Margin. This lesson neatly summarizes the key concepts and requirements facing investors wanting to sell short stocks at Interactive Brokers. A minimum floor of % will be charged on margin loans. Rates subject to change. May be subject to a 1% surcharge applied to the spread if financing is not. You need to maintain a minimum equity of at least $2, or % of the margin requirement, whichever is less. 3. If trading futures or forex, check that you. To upgrade to a Portfolio Margin account, you must be approved to trade options and your account must have at least USD , (or USD equivalent) in Net. Please also note that margin requirements are subject to change as determined by Interactive Brokers as well as by changing market conditions. Let's start with. You must have stocks margin trading permissions in order to have options margin trading permissions. US Securities regulations require at least 25, USD in. To establish the margin requirement, exchanges typically calculate and post product price thresholds, that is the maximum permitted daily price move for a.